This is a travel blog! Why are we talking about finances and banks? Because it's too important to not let you know!

Did you know? The world's 60 largest banks financed fossil fuels with a staggering $705 billion in 2023 alone, according to the Banking on Climate Chaos 2024 report. While we meticulously plan low impact trips, packing reusable containers and choosing trains over planes, the money sitting in our bank accounts might be working directly against our efforts. We hope this article helps empower you to make informed financial decisions that truly support your sustainable ethos, moving beyond just travel habits to encompass your financial footprint.

The Hidden Climate Cost in Your Bank Account

Many of us don't think about what happens to our money once it's deposited. Yeah, we care about the interest and that's pretty much it. Yet, major banks often act as financial engines for the fossil fuel industry. If you deposit 1000 dollars in your account, the bank is only required to keep 10% of that in cash. The 90% of the rest is invested (That's how banks give out loans!) They provide enormous loans and underwriting services that fund oil extraction, gas pipelines, and coal power plants. This financial backing is essential for these projects to move forward, directly contributing to the climate crisis we're trying to mitigate through conscious travel.

Choosing a bamboo toothbrush while your bank funds a new oil pipeline? Feels counterintuitive, right? This disconnect highlights a significant gap between our daily sustainable actions and where our money spends rests at night. (and day!)

For travelers dedicated to minimizing their impact, realizing their savings might be supporting the very industries harming the planet can be jarring. The goal isn't guilt, but awareness. Understanding this link is the first step toward bridging the gap between our sustainable travel intentions and our financial actions. It opens the door to making eco friendly financial choices that align more closely with our values.

So how do we begin? Identifying Banks That Fund Fossil Fuels

So, how do you find out if your bank is part of the problem? The first step involves a bit of investigation, often referred to as 'divestment' research. This simply means looking into whether your financial institution's investments align with your values, particularly concerning fossil fuels. You can start by visiting your bank's official website. Look for sections labeled 'Sustainability Reports,' 'ESG (Environmental, Social, Governance) Policies,' or 'Investment Policies.' Be prepared, though; the level of transparency varies wildly between institutions. Currently, there is no clear ESG policy. It's pretty much up to the companies discretion.

Thankfully, you don't have to rely solely on the banks' own reporting. Independent organizations track this information meticulously. Resources like the annual Banking on Climate Chaos report, published by BankTrack and other NGOs, provide detailed analyses of which banks are the biggest funders of fossil fuels globally. These reports examine lending and underwriting data, offering a clearer picture than marketing materials might suggest. We use bank.green to decide which banks to avoid and choose! They're a nonprofit organization that scores banks on fossil fuel / sustainability.

When researching, keep an eye out for common 'red flags' that signal significant fossil fuel involvement:

- Major financing roles in controversial projects like specific pipelines or Arctic drilling initiatives.

- An absence of clear, time bound policies to exclude or phase out fossil fuel investments.

- Vague sustainability language without measurable targets or transparent reporting, often a sign of 'greenwashing'.

- Membership in industry associations known for lobbying against climate action policies.

Finding definitive information can sometimes feel like searching for a needle in a haystack, but persistence pays off. Think of this research as the first step in creating your personal divest from fossil fuels guide, empowering you to make informed decisions about where your money resides and choosing fossil fuel free banks. (They exist now in the United States)

Choosing Financial Institutions Supporting a Greener Future

Once you understand the impact of conventional banking, the next step is finding alternatives that actively support a healthier planet. What makes a bank 'green' or 'ethical'? It's usually a combination of factors: transparent investment policies that clearly state what they *won't* fund (like fossil fuels), active investment in renewable energy or community development projects, and sometimes official certifications like B Corp status. Many are members of networks like the Global Alliance for Banking on Values (GABV), signifying a commitment to using finance for positive social and environmental impact.

Several types of institutions offer ethical banking options. Credit unions are member owned cooperatives, often deeply rooted in their local communities, which can translate to more responsible local lending. Community Development Financial Institutions (CDFIs), particularly in the US, have a primary mission to serve underserved communities, sometimes including funding for local green initiatives. Then there are banks explicitly dedicated to sustainability, sometimes called 'green banks', which build their entire model around environmental criteria and fossil fuel exclusion.

To help navigate these choices, here’s a general comparison:

| Institution Type | Key Feature | Potential Environmental Focus | Consideration |

|---|---|---|---|

| Credit Union | Member-owned, community focus | Often local lending, may have specific green initiatives | Services/reach might be more localized, check if they have mission focus. Possible they still fund fossil fuels. |

| Community Development Bank (CDFI) | Mission-driven for underserved communities | May fund local green projects, affordable housing | Focus is broader, they may still fund fossil fuels. |

| Dedicated Green Bank | Explicit environmental mission | Direct funding for renewables, fossil fuel exclusion policies, invest in conservation projects | May be online-only, newer institutions. |

| B Corp Certified Bank | Verified social & environmental performance | Commitment to positive impact, transparency | Certification covers overall operations, not just lending, and B Corp still has there loopholes although it's a good start. |

Note: This table provides a general comparison. Specific offerings and environmental commitments vary widely between individual institutions. Research specific banks based on these categories.

Remember, the goal is progress, not necessarily finding a 'perfect' institution overnight. Look for banks actively moving away from fossil fuels and demonstrating a commitment to positive impact. Don't hesitate to ask potential new banks direct questions: "Do you have a policy excluding fossil fuel project financing?" or "Where can I see details of the projects you fund?" Viable, value aligned alternatives do exist. Another thing to do? Advocate! Maybe you do choose to switch banks, tell your current bank WHY you're closing your account.

Investing Your Savings Directly in Sustainable Endeavors

Beyond choosing an ethical bank for your everyday checking and savings, you can also proactively use your capital to support green initiatives directly through investments. It's important to distinguish this from banking; investments carry different levels of risk and potential return compared to insured bank deposits. However, they offer a chance for more direct impact.

Several avenues allow individuals to channel funds towards sustainability. Green Bonds or Climate Bonds are essentially loans issued by governments or corporations specifically for environmental projects. Imagine your investment helping fund an electric rail network you might later travel on, or supporting conservation projects that protect beautiful natural destinations. Another option involves Impact Investing Platforms. These online platforms connect investors with businesses aiming for clear social or environmental outcomes. You might find opportunities to support eco tourism startups, sustainable farms supplying local restaurants in travel hotspots, or community renewable energy projects.

Equity Crowdfunding presents another possibility. Some platforms feature startups developing sustainable technology, apps designed to help track our carbon footprint. These investments allow you to directly support innovation in the sustainable space which hopefully can expand into travel. Do your research! Make sure they're not greenwashing and are actually creating truly sustainable ideas. Example: the NICE car is something I find so innovating yet a true green product (Reuse, Upcycle.)

Crucially, thorough research is essential before committing funds. These are investments, meaning your capital is at risk. Understand the specific project or company, the potential returns, the associated risks, and the platform's fees. Don't hesitate to seek independent financial advice if you're unsure. Exploring these green investment opportunities requires diligence, but offers a powerful way to put your money to work for the future you want to see. A good tip to remember: Only invest an amount you CAN afford to lose.

Practical Steps to Move Your Money Ethically

Okay, you've researched the issues, identified problematic banks, and found a potential ethical alternative. Now for the practical part: actually making the switch. It might seem daunting, like repacking your entire backpack mid trip, but breaking it down makes it manageable. Here’s a straightforward process:

- Research & Choose: Finalize your selection of a new ethical bank or credit union based on the criteria discussed earlier – their fossil fuel policies, investment transparency, and alignment with your values.

- Open New Account: Start the application process with your chosen institution. This can often be done online or sometimes requires an in person visit. You'll typically need standard identification and proof of address.

- Transition Finances Gradually: This is key to a smooth switch. Start by moving some funds to the new account. Most importantly, update your direct deposit information (like your paycheck) to go to the new account. Then, systematically switch over any automatic payments or bill pays linked to your old account. It’s wise to keep the old account open with a small balance for a month or two just in case any payments were missed.

- Close Old Account: Once you're confident all automatic transactions are routed through your new account, formally close the old one. Tell them WHY you're doing it. No banks like to lose customers, if enough people do this, they'll start to be a systematic change.

Yes, switching involves some administrative effort. But think of it as a one time investment for long term peace of mind. Often, ethical banks or credit unions might even have lower fees than their massive conventional counterparts. Taking these steps is a concrete action that strengthens your overall approach to sustainable travel finance, ensuring your money isn't silently undermining your conscious travel choices.

Extending Green Principles to Other Travel Finances

Aligning your finances with your values doesn't stop at your primary bank account or investments. Consider the broader picture of financial tools you use, especially those related to travel. Take credit cards, for example. If you've switched to an ethical bank or credit union, see if they offer a credit card that meets your needs. Some cards might offer rewards like donations to environmental charities or points that can be used for carbon offsetting. Currently, there aren't much great choices since sometimes the brander and issuer of the card are the same, but often they are not – and the issuer is who determines whether the fees associated with using the card align with your values. Those fees include:

- Annual fees you pay to use the card (not all credit cards have this).

- Interest fees you pay if you carry a balance from month to month (often quite high).

- Transaction fees that merchants pay (usually around 3% of the purchase price).

While dedicated 'eco' credit cards are still evolving, resources like Green America list credit cards from more responsible banks or those offering environmental rewards. I'll say start by being responsible with your credit card is a great step. (Remember, the more interest you pay means more of it may fund polluters)

Travel insurance is another area, though finding explicitly 'green' options is currently challenging. If possible, consider the provider's overall ESG (Environmental, Social, Governance) reputation when choosing a policy, but recognize this information might be harder to find and verify for insurers compared to banks.

Ultimately, these financial shifts work best when they complement your conscious spending choices. Choosing to support local artisans, dining at restaurants using local produce, opting for public transportation, and actively minimizing waste on the road (like packing reusable meal kits, inspired by experiences like those documented in our How to Zero Waste when you're in a hurry?) are all part of the same holistic approach. True sustainable travel involves weaving environmental consciousness through every thread of your journey, including how you bank, invest, pay, and spend.

Bonus: Spending less through self-reliance

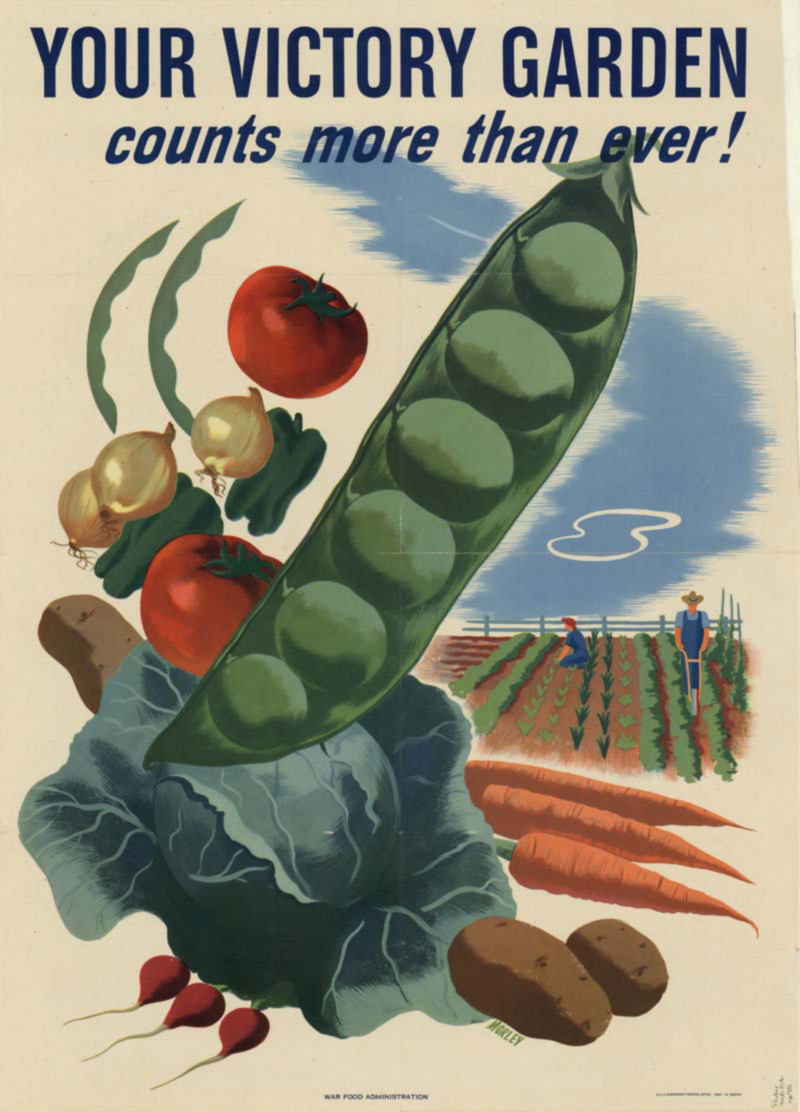

I think most of us grew up with perfectly mowed lawns and ornamental gardens in the backyard. But did you know during World War 2, Victory Gardens was a patriotic duty, with millions of Americans growing their own food to support the war effort. This unfortunately changed after the war to what we are today.

It's never to late to start again! Growing your own food means healthier, tastier, and less reliance on money. This means you're also more resilient to "external forces", like the stock market or whatever new trade wars that are going on. Your veggies in the backyard won't fluctuate in price!

Happy Travels!