這是一個旅行部落格!為什麼我們要談論金融和銀行?因為這件事實在太重要,不能不告訴你!

你知道嗎?根據《2024年氣候混亂銀行報告》(Banking on Climate Chaos 2024),光是在2023年,全球最大的60家銀行就為化石燃料產業提供了高達7,050億美元的融資。當我們細心規劃低碳旅行、準備可重複使用的容器、選擇搭火車而非飛機時,我們存在銀行帳戶裡的錢卻有可能正反向地支持那些破壞環境的產業。我們希望這篇文章能幫助你做出更有意識的財務選擇,不只是在旅行習慣上實踐永續精神,也能擴展到你的金錢足跡。

你銀行戶頭裡的環境隱形殺手

我們當中許多人從未思考過,當我們把錢存進銀行後會發生什麼事。是啊,我們可能只在意利息? 其他的就不太關心了。但事實上,大型銀行往往是化石燃料產業的金流引擎。如果你把10000台幣存進帳戶,銀行只需要保留其中10%的現金,剩下的90%則會被拿去投資(這就是銀行如何發放貸款的方式!)。他們提供鉅額貸款與承銷服務,用來資助石油開採、天然氣管線建設與燃煤發電廠的興建。這些金融支持是這些污染項目得以進行的關鍵,直接助長了我們透過有意識的旅行努力想要減緩的氣候危機。

你買竹牙刷來減少塑膠使用,結果你的銀行卻在資助新的石油管線?是不是有點本末倒置?這種矛盾揭示出我們日常永續行動與我們的金錢實際用途之間的巨大落差,其實我們的錢可能都在為環境破壞出力。

對於我們零浪費旅行者來說,發現自己的存款可能正在支持破壞地球的產業,這種衝擊是很難忽視的。這不是在灌輸罪惡感,而是希望喚起意識。了解這層關聯,是彌合我們零浪費永續旅行的意圖與實際財務行動之間鴻溝的第一步。這也開啟了大門,讓我們能做出更符合價值觀的環保財務選擇。

所以如何開始? 先了解哪些銀行正在投資化石原料

那麼,我們要如何查出自己的銀行是否「有問題」呢?第一步就是做一點小調查,這通常被稱為「撤資研究」(divestment research)。意思就是檢視你的金融機構的投資是否與你的價值觀相符,尤其是在化石燃料方面。你可以先從造訪銀行的官方網站開始,尋找標示為「永續發展報告」、「ESG(環境、社會、公司治理)政策」或「投資政策」的區塊。不過要有心理準備:不同金融機構在資訊透明度上差異很大。目前並沒有一套明確的 ESG 標準,基本上是否公開透明,全憑各家公司自願。或許他們宣稱我們依照ESG去做投資選擇,但真正的行為並沒有公開,這部分在台灣還有很大努力的空間。

好消息是你不必只靠銀行自己提供的資訊。有些獨立機構會非常詳盡地追蹤這些資料。像是由 BankTrack 與其他非政府組織每年發布的《Banking on Climate Chaos》報告,就深入分析了全球哪些銀行是化石燃料的最大金主。這些報告會檢視貸款與承銷的數據,呈現出比銀行行銷材料更真實的全貌。我們自己使用 Bank Green 來判斷該避開與選擇哪家銀行!這是一個非營利組織,專門針對銀行的化石燃料投資與永續表現打分數。可惜、目前 Bank Green 台灣銀行名單非常少。

在進行調查時,請留意一些常見的「紅旗警訊」,這些通常代表該銀行與化石燃料產業有密切關聯:

- 在具爭議性的專案中扮演主要融資角色,例如特定的輸油管線或北極鑽油行動。

- 沒有明確、具時間表的政策來排除或逐步淘汰化石燃料投資。

- 使用模糊的永續語言,但缺乏可量化的目標或透明的報告,這通常是「漂綠」(greenwashing)的跡象。

- 反對氣候行動政策聞名的產業協會成員。

要找到明確的資訊有時就像是在大海撈針,但只要你堅持下去,就一定會有所收穫。把這項研究當作你「個人撤資指南」的第一步,它能幫助你做出有意識的選擇,讓你的資金放在不支持化石燃料的銀行裡。(這樣的銀行現在在美國已經存在囉! 台灣需要透過大家的努力也一併進行!)

Choosing Financial Institutions Supporting a Greener Future

Once you understand the impact of conventional banking, the next step is finding alternatives that actively support a healthier planet. What makes a bank 'green' or 'ethical'? It's usually a combination of factors: transparent investment policies that clearly state what they *won't* fund (like fossil fuels), active investment in renewable energy or community development projects, and sometimes official certifications like B Corp status. Many are members of networks like the Global Alliance for Banking on Values (GABV), signifying a commitment to using finance for positive social and environmental impact.

Several types of institutions offer ethical banking options. Credit unions are member owned cooperatives, often deeply rooted in their local communities, which can translate to more responsible local lending. Community Development Financial Institutions (CDFIs), particularly in the US, have a primary mission to serve underserved communities, sometimes including funding for local green initiatives. Then there are banks explicitly dedicated to sustainability, sometimes called 'green banks', which build their entire model around environmental criteria and fossil fuel exclusion.

To help navigate these choices, here’s a general comparison:

| Institution Type | Key Feature | Potential Environmental Focus | Consideration |

|---|---|---|---|

| Credit Union | Member-owned, community focus | Often local lending, may have specific green initiatives | Services/reach might be more localized, check if they have mission focus. Possible they still fund fossil fuels. |

| Community Development Bank (CDFI) | Mission-driven for underserved communities | May fund local green projects, affordable housing | Focus is broader, they may still fund fossil fuels. |

| Dedicated Green Bank | Explicit environmental mission | Direct funding for renewables, fossil fuel exclusion policies, invest in conservation projects | May be online-only, newer institutions. |

| B Corp Certified Bank | Verified social & environmental performance | Commitment to positive impact, transparency | Certification covers overall operations, not just lending, and B Corp still has there loopholes although it's a good start. |

Note: This table provides a general comparison. Specific offerings and environmental commitments vary widely between individual institutions. Research specific banks based on these categories.

Remember, the goal is progress, not necessarily finding a 'perfect' institution overnight. Look for banks actively moving away from fossil fuels and demonstrating a commitment to positive impact. Don't hesitate to ask potential new banks direct questions: "Do you have a policy excluding fossil fuel project financing?" or "Where can I see details of the projects you fund?" Viable, value aligned alternatives do exist. Another thing to do? Advocate! Maybe you do choose to switch banks, tell your current bank WHY you're closing your account.

Investing Your Savings Directly in Sustainable Travel

Beyond choosing an ethical bank for your everyday checking and savings, you can also proactively use your capital to support green initiatives directly through investments. It's important to distinguish this from banking; investments carry different levels of risk and potential return compared to insured bank deposits. However, they offer a chance for more direct impact.

Several avenues allow individuals to channel funds towards sustainability. Green Bonds or Climate Bonds are essentially loans issued by governments or corporations specifically for environmental projects. Imagine your investment helping fund an electric rail network you might later travel on, or supporting conservation projects that protect beautiful natural destinations. Another option involves Impact Investing Platforms. These online platforms connect investors with businesses aiming for clear social or environmental outcomes. You might find opportunities to support eco tourism startups, sustainable farms supplying local restaurants in travel hotspots, or community renewable energy projects.

Equity Crowdfunding presents another possibility. Some platforms feature startups developing sustainable technology, apps designed to help track our carbon footprint. These investments allow you to directly support innovation in the sustainable space which hopefully can expand into travel. Do your research! Make sure they're not greenwashing and coming up with truly sustainable ideas. Like the NICE car is something I find so innovating yet truly green product. Also note that there will always be risk in investing.

Crucially, thorough research is essential before committing funds. These are investments, meaning your capital is at risk. Understand the specific project or company, the potential returns, the associated risks, and the platform's fees. Don't hesitate to seek independent financial advice if you're unsure. Exploring these green investment opportunities requires diligence, but offers a powerful way to put your money to work for the future you want to see.

Practical Steps to Move Your Money Ethically

Okay, you've researched the issues, identified problematic banks, and found a potential ethical alternative. Now for the practical part: actually making the switch. It might seem daunting, like repacking your entire backpack mid trip, but breaking it down makes it manageable. Here’s a straightforward process:

- Research & Choose: Finalize your selection of a new ethical bank or credit union based on the criteria discussed earlier – their fossil fuel policies, investment transparency, and alignment with your values.

- Open New Account: Start the application process with your chosen institution. This can often be done online or sometimes requires an in person visit. You'll typically need standard identification and proof of address.

- Transition Finances Gradually: This is key to a smooth switch. Start by moving some funds to the new account. Most importantly, update your direct deposit information (like your paycheck) to go to the new account. Then, systematically switch over any automatic payments or bill pays linked to your old account. It’s wise to keep the old account open with a small balance for a month or two just in case any payments were missed.

- Close Old Account: Once you're confident all automatic transactions are routed through your new account, formally close the old one. Tell them WHY you're doing it. No banks like to lose customers, if enough people do this, they'll start to be a systematic change.

Yes, switching involves some administrative effort. But think of it as a one time investment for long term peace of mind. Often, ethical banks or credit unions might even have lower fees than their massive conventional counterparts. Taking these steps is a concrete action that strengthens your overall approach to sustainable travel finance, ensuring your money isn't silently undermining your conscious travel choices.

Extending Green Principles to Other Travel Finances

Aligning your finances with your values doesn't stop at your primary bank account or investments. Consider the broader picture of financial tools you use, especially those related to travel. Take credit cards, for example. If you've switched to an ethical bank or credit union, see if they offer a credit card that meets your needs. Some cards might offer rewards like donations to environmental charities or points that can be used for carbon offsetting. Currently, there aren't much great choices since sometimes the brander and issuer of the card are the same, but often they are not – and the issuer is who determines whether the fees associated with using the card align with your values. Those fees include:

- Annual fees you pay to use the card (not all credit cards have this).

- Interest fees you pay if you carry a balance from month to month (often quite high).

- Transaction fees that merchants pay (usually around 3% of the purchase price).

While dedicated 'eco' credit cards are still evolving, resources like Green America list credit cards from more responsible banks or those offering environmental rewards. I'll say start by being responsible with your credit card is a great step. (Remember, the more interest you pay means more of it may fund polluters)

Travel insurance is another area, though finding explicitly 'green' options is currently challenging. If possible, consider the provider's overall ESG (Environmental, Social, Governance) reputation when choosing a policy, but recognize this information might be harder to find and verify for insurers compared to banks.

Ultimately, these financial shifts work best when they complement your conscious spending choices. Choosing to support local artisans, dining at restaurants using local produce, opting for public transportation, and actively minimizing waste on the road (like packing reusable meal kits, inspired by experiences like those documented in our How to Zero Waste when you're in a hurry?) are all part of the same holistic approach. True sustainable travel involves weaving environmental consciousness through every thread of your journey, including how you bank, invest, pay, and spend.

Bonus: Spending less through self-reliance

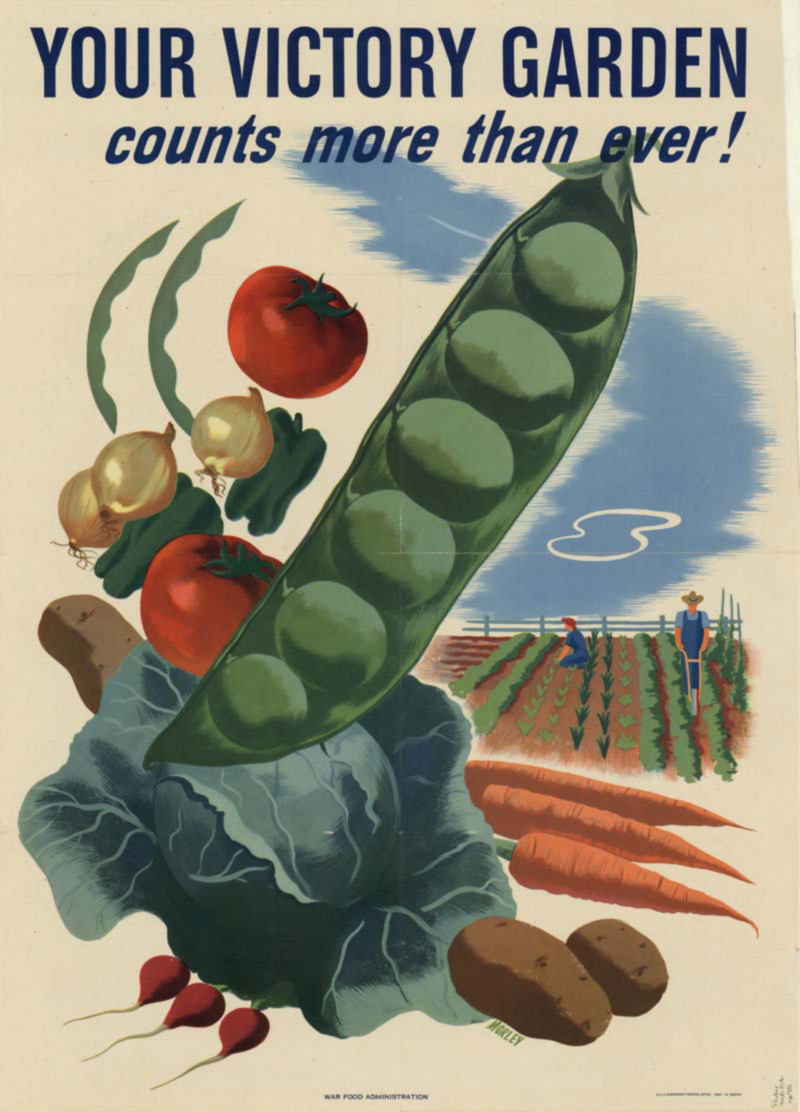

I think most of us grew up with perfectly mowed lawns and ornamental gardens in the backyard. But did you know during World War 2, Victory Gardens was a patriotic duty, with millions of Americans growing their own food to support the war effort. This unfortunately changed after the war to what we are today.

It's never to late to start again! Growing your own food means healthier, tastier, and less reliance on money. This means you're also more resilient to "external forces", like the stock market or whatever new trade wars that are going on. Your veggies in the backyard won't fluctuate in price!

Happy Travels!